Enkel & Automatiserad RUT-avdrag

registrering för flera branscher!

Rut-avdrag för Tvätterier & Kemtvätt

Rut-avdrag för dig som arbetar inom följande områden:

Flytt och Transport, Städbolag, Möblering, Reperation av vitvaror och för dig som åker hem till kund.Flytt och Transport, Städbolag, Möblering, Reperation av vitvaror och för dig som åker hem till kund.

Antal rutregistreringar per månad

Antal kunder per månad

Antal avtal med kunder per månad

RuT-tjänsten erbjuds för dig som arbetar inom följande områden:

Tvätteri

För dig som driver ett tvätteri / kemtvätt

Flytta, packa & transportera kundens bohag

För dig som driver en flyttfirma

Städbolag

För dig som driver ett städbolag

Möblering

För dig som förflyttar, monterar och demonterar möbler/trädgårdsmöbler, studsmattor, upplåsbara pooler och lösöre.

Reperation av vitvaror

För dig som reparerar vitvaror såsom tvättmaskin, torktumlare, torkskåp, mangel, diskmaskin, kyl, vinkyl, frys, spis, spishäll, köksfläkt, ugn, mikrovågsugn m.m.

Åker hem till kund för att:

- tvätta, stryka och laga kläder, sängkläder, gardiner och avtagbar soffklädsel

- lägga upp kläder och gardiner

- sätta upp och ta ned gardiner

- putsa skor.

RuTTex RUT-avdrag – är en tjänst med många fördelar för alla inblandade

När du erbjuder RUT-avdrag blir det en vinst för alla inblandade. För kunden innebär det lägre kostnader för dina tjänster, och för dig innebär det en trygg och effektiv process där pengarna snabbt betalas tillbaka från Skatteverket.

Ruttex hjälper företag att växa

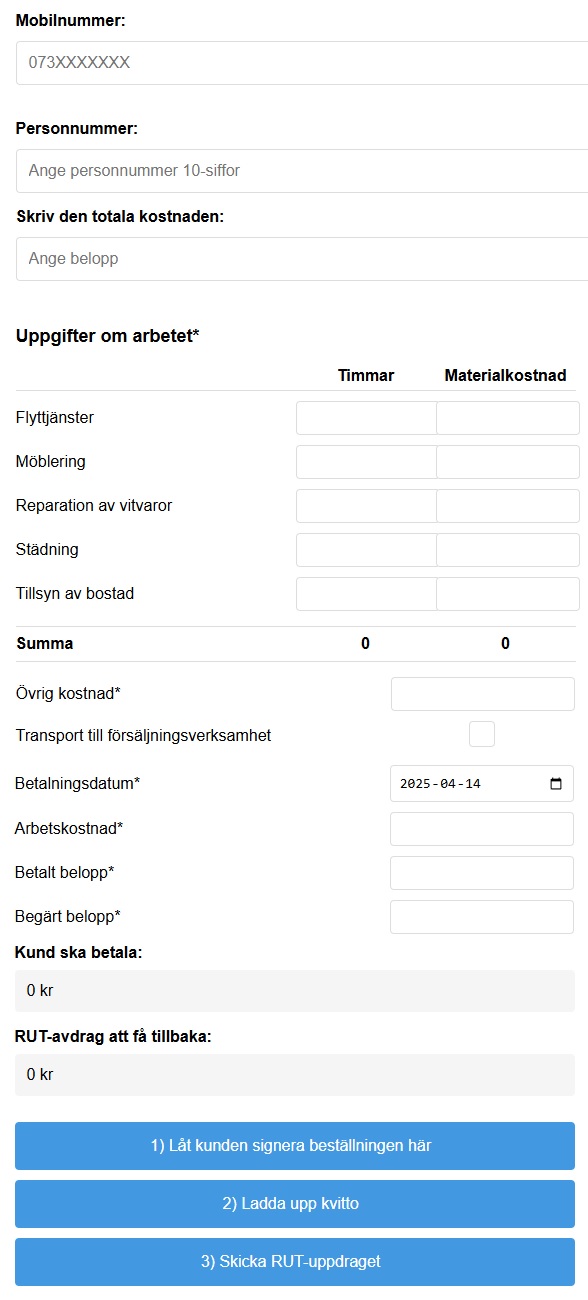

1) Räkna ut hur mycket kunden ska betala, hur mycket du kommer få tillbaka,

2) sök om avtal finns mellan dig och kund,

3) skapa avtal om det är en ny kund,

4) skicka iväg RUT-avdrag begäran,

— Du gör ALLT detta på mindre än 20 sekunder

och vi sköter resten åt dig!

Registrera RUT-avdrag på mindre än 20 sekunder

Skapa avtal med kund på mindre än 5 sekunder.

Sök efter avtal på mindre än 5 sekunder

Räkna ut hur mycket kunden ska betala med rut med vår RUTkalkylator

Lägre Kostnader för Kunden

Med RUT-avdrag blir tjänsterna mer attraktiva för kunderna, eftersom de kan dra av 50 % av arbetskostnaden för tjänsten direkt på kvittot/fakturan. Det gör det inte bara mer prisvärt utan också enklare för kunden att välja professionella tjänster.

Startpaket: Tablet 8,7 tum + Roterbart stand / Tablet fordral med stand + Laddare

Väljer du att fortsätta som kund efter testperioden, erbjuder vi dig ett startpaket som innehåller en Tablet (Redmi PAD SE 8,7) + Roterbart stand eller Tablet fordral med stand + Laddare

Fördelarna med att erbjuda RUTavdrag med RuTTex.

Anpassat för Skatteverkets Regelverk: RuTTex-plattformen är byggd för att säkerställa att varje registrering och hantering av RUT-avdrag uppfyller Skatteverkets krav. Vi håller oss alltid uppdaterade med de senaste förändringarna i regelverket, vilket innebär att du kan lita på att dina uppgifter hanteras på rätt sätt.

Information och Stöd för Våra Kunder: Förutom att erbjuda ett automatiserat system för RUT-avdrag, tillhandahåller vi även tydlig och uppdaterad information om regelverket kring RUT-avdrag. På så sätt kan våra kunder enkelt förstå vilka tjänster som omfattas och vilka förutsättningar som gäller för att kunna begära RUT-avdrag.

Billigare för kunden att nyttja dina tjänster utan att du förlorar något på det.

Ökad konkurrenskraft: Genom att erbjuda RUT-avdrag blir dina tjänster mer prisvärda och attraktiva.

Långsiktiga Ekonomiska Fördelar: Genom att använda RuTTex-systemet maximerar du din tid och minimerar dina kostnader. Färre resurser behövs för att hantera administration, vilket i längden ökar din lönsamhet och skapar en stabil grund för företagets tillväxt.

Långsiktiga Ekonomiska Fördelar:

- 100% Regelverkssäkert: Anpassat för att följa Skatteverkets riktlinjer.

- Aktuell Information: Alltid uppdaterad om de senaste reglerna för RUT-avdrag.

- Enkel Registrering: Smidigt och tidseffektivt – vi gör det enkelt för dig.

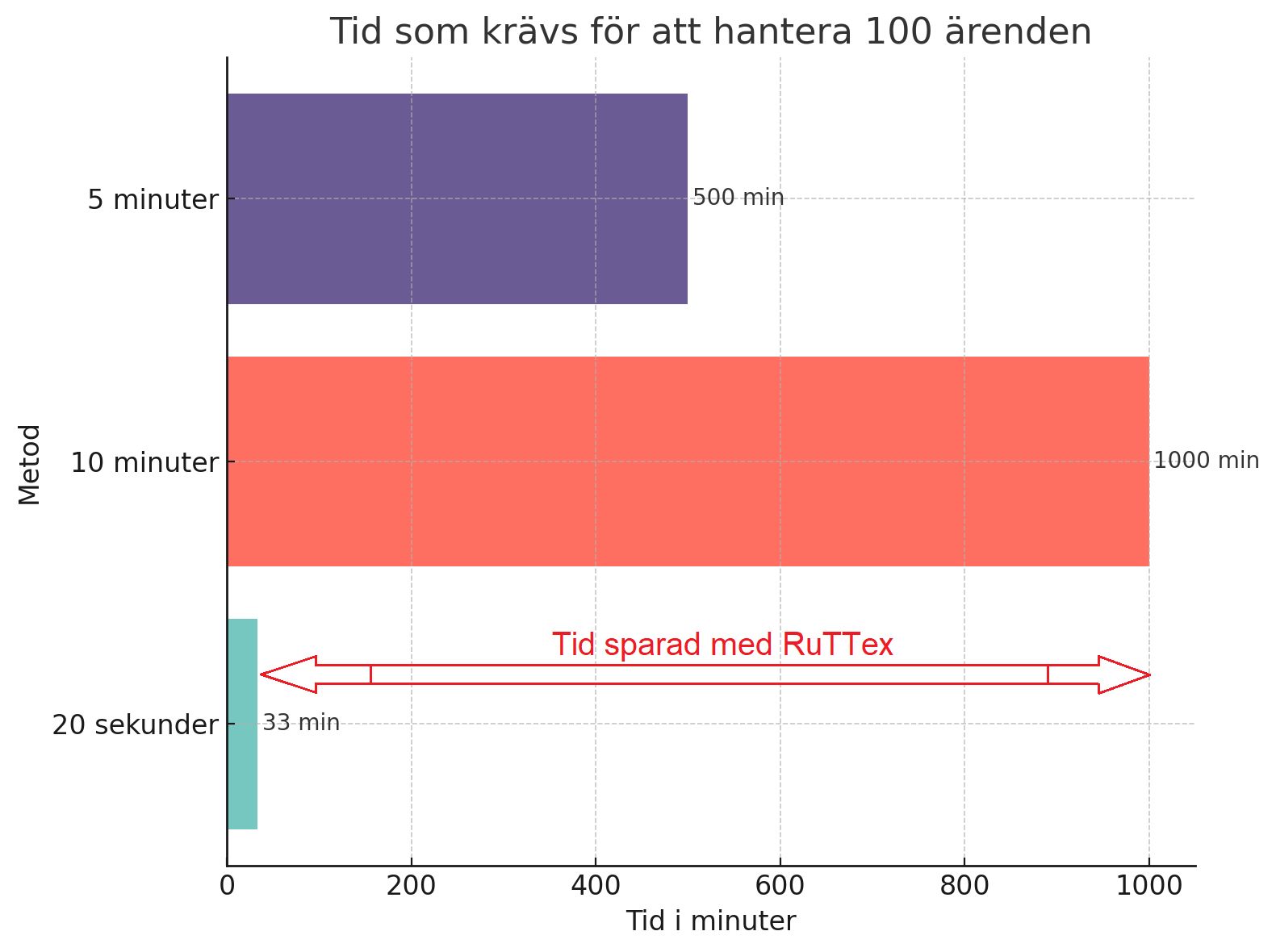

Det tar mindre än 20 sekunder att registrera och skicka iväg en ansökan till Skatteverket för RUTavdrag med RuTTex.

Tid som krävs för att hantera 100x ärenden!

Det är både tidskrävande, och registreringen kräver manuell hantering. Vid manuell hantering kan varje registrering ta upp till 10 minuter att registrera.

Exempel 1: Om det tar 10 minuter att registrera en Rut-avdrag ansökan och du manuellt registrerar 100 ansökningar per dag, kommer det att ta cirka 16 timmar och 40 minuter att registrera alla ärenden varje dag.

Exempel 2: Om det tar 10 minuter att registrera en Rut-avdrag ansökan och du manuellt registrerar 100 ansökningar per dag, kommer det att ta cirka 8 timmar och 20 minuter att regostrera alla ärenden varje dag.

Med RuTTex RUT-avdrag systemhantering kommer det att ta dig ca 20 sekunder att registrera en Rut-avdrag begäran till Skatteverket.

Kostnadsberäknare för Manuell Registrering

En anställd kommer kosta dig minst 197kr per timme inklusive arbetsgivaravgiften, semesterlönen och försäkringskostnader.

Resultat

Total registreringstid: 8 timmar 20 minuter

Kostnad för Manuell Registrering

Kostnad per dag: 0 kr

Säker datahantering

GDPR

- Vi hanterar all data på ett säkert och ansvarsfullt sätt.

- Vi följer gällande dataskyddsregler och säkerställer att all data behandlas med högsta säkerhet.

Lagring av data

All data lagras och bearbetas enbart inom Sverige. Personuppgifter såsom personnummer, namn och telefonnummer lagras endast på svenska servrar.

Aktörer inblandade

Endast två aktörer har tillgång till datan: Du och RuTTex. RuTTex har utvecklat egna system för att säkerställa dataskydd och integritet.

Du får betalt av Skatteverket

Som företagare behöver du inte vänta länge på att få ersättning. När kunden betalar sin del av kostnaden, hanterar vi processen så att Skatteverket betalar ut resterande belopp direkt till ditt konto. Det är en smidig och säker process som stärker ditt kassaflöde och gör det enkelt att erbjuda tjänster med RUT-avdrag.

Testa i 30 dagar

Testa våra tjänster i 30 dagar utan kostnad. Du kan när som helst under testperioden välja att avsluta våra tjänster.

Begränsningar under test perioden:

* Max 10 st rutavdrag ansökningar till Skatteverket.

* Max 10 st avtalsskrivningar med kund.

* Max 100 st SMS utskick

* Du måste skriva ett DPA(Databehandlingsavtal) innan du sätter igång.

Få pengar tillbaka med RUT-avdraget

Med RuTTex får du inte bara ett kraftfullt verktyg för att hantera RUT-avdrag, utan också en partner som säkerställer att du har all nödvändig information för att kunna använda avdraget på rätt sätt.

Vill du veta mer om hur vi kan hjälpa dig? Kontakta oss idag och upptäck en enklare väg till RUT-hantering!

Nackdelar med manuell RUT-avdrag hantering.

Ökade Kostnader för tid och personal

- Längre Bearbetningstid: Om varje ärende tar 5–10 minuter istället för 20 sekunder, ackumuleras enorma tidsförluster vid hög volym. Det krävs mer personal för att hantera ärendena, vilket resulterar i högre lönekostnader.

- Lägre Effektivitet: Personalens tid binds upp i administrativa uppgifter istället för att ägna sig åt värdeskapande arbete, vilket begränsar verksamhetens tillväxtpotential.

Högre Risk för Felhantering

- Manuella Fel: Manuella processer är mer benägna att leda till felregistreringar, som kan resultera i avslag från Skatteverket eller krav på kompletteringar. Detta innebär onödig administration och förlorad tid.

- Minskad Kundnöjdhet: Felaktig hantering av RUT-avdrag kan skapa frustration hos kunder, vilket påverkar förtroendet och risken att tappa kunder ökar.

Lägre Konkurrenskraft

- Mindre Attraktivt för Kunder: Kunder föredrar leverantörer som snabbt och smidigt hanterar RUT-avdrag. En långsam eller osäker process kan göra att kunder väljer konkurrenter som erbjuder bättre lösningar.

- Förlorade Affärsmöjligheter: Utan ett effektivt system som RuTTex kan det vara svårt att hantera större volymer av kunder, vilket begränsar företagets tillväxt och intäkter.

Ökad Administrativ Börda

- Tid som Går förlorad på Rutinarbete: Utan automatisering läggs mycket tid på att manuellt registrera och hantera ärenden, vilket inte bara är ineffektivt utan också tröttsamt för personalen.

- Lägre Precision: Ett automatiserat system följer alltid regelverket korrekt. Manuella processer riskerar att missa viktiga detaljer, vilket kan leda till problem vid granskning.

Onödig Stress och Frustration

- Mer Komplex Hantering: När personalen tvingas navigera genom manuella processer ökar risken för misstag och stress. Detta kan leda till en sämre arbetsmiljö och högre personalomsättning.

Sämre Skalbarhet

- Begränsad Kapacitet: När verksamheten växer och antalet ärenden ökar blir det svårt att hantera hög volym manuellt. Utan ett automatiserat system kan företaget snabbt nå sin kapacitetsgräns.

- Hämmande för Tillväxt: Utan en effektiv lösning begränsas möjligheten att ta in fler kunder eller utöka tjänsteutbudet, vilket hämmar företagets tillväxt.

Risk för Fel i Regeluppföljning

- Missar i Regeländringar: Skatteverkets regler kan ändras, och det manuella arbetet riskerar att inte alltid vara uppdaterat. RuTTex håller automatiskt systemet uppdaterat enligt gällande regelverk.

- Kostsamma Konsekvenser: Felregistreringar på grund av regelmissar kan leda till ekonomiska förluster, böter eller krav på återbetalning från Skatteverket.

Risk för Förlorade Intäkter

- Möjligheter som Går Förlorade: Ett ineffektivt system kan leda till missade affärsmöjligheter, som att snabbt kunna hantera fler kunder eller erbjuda nya tjänster.

- Ökad Kundbortfall: Om kunderna upplever långa väntetider eller felhantering finns risken att de vänder sig till konkurrenter med bättre lösningar.